The need for affordable housing has never been under as much scrutiny as it is today, due to population increases and regular shortfalls in new housing targets.

Recently released figures from Land Registry have revealed that the average UK house price stands at £183,861, which is a 4.6% increase from last year.

With this in mind, Howells Solicitors has put together some advice for first time buyers, so they’ll be able to fully prepare themselves financially before they take their first steps on the property ladder.

How much deposit do you need for a mortgage?

The first step to consider is the amount of deposit you want to place on a property. Please see the list below for deposit percentages based on the average UK house price (£183,861).

5-10% Deposit (£9,193 – £18,386): If you place a deposit between 5-10% you may find a suitable mortgage but interest rates will be high compared to those available with higher deposits.

10-15% Deposit (£18,386 – £27,579): Deposits from 10-15% increases your chances of receiving better mortgage deals but interest rates will still be high.

15-25% Deposit (£27,579 – £45,965): If you’re able to afford a deposit between 15-25% you should benefit from smaller interest rates from a wider variety of mortgage providers.

25%-40% Deposit (£45,965 – £73,544): To be able to access the best interest rates on the market, you will need to place down a staggering 25-40% deposit.

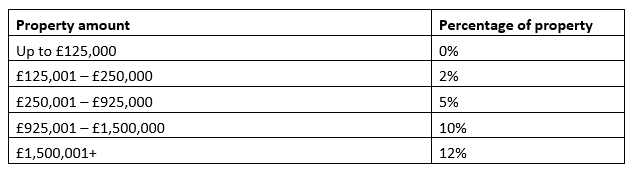

How much is stamp duty?

Based on the average UK house price (£183,861) the total stamp duty would cost (£1,177.22).

Please see the below table for how stamp duty is calculated.

Help to Buy

The government offer an equity loan under their Help to Buy scheme. This will enable you to lend up to 20% of the price of a new build property, meaning you can put forward as little as a 5% deposit which will leave a 75% mortgage.

So, if you purchase a new build property at the average UK house price (£183,861) you can place a 5% deposit of £9,193 and the government will put in a 20% deposit of £36,722. The remaining 75% mortgage would therefore be for £137,869.

For the first five years you won’t pay interest on the 20% equity loan. If the loan has not been repaid after five years you will start to pay interest. Please note, if the equity loan is not repaid and you sell the property you will be liable to pay back 20% of the current market value. For more details on the interest rates please click here.

Mortgage Guarantee

The mortgage guarantee scheme essentially works in the same way as other mortgages. The difference being that the government will offer the mortgage lender the option to purchase a guarantee on the mortgage amount.

With the support from the government, mortgage lenders will be able to offer buyers a better high loan to value mortgage.

Based on the average UK house price (£183,861) you will need to place a minimum of a 5% deposit (£9,193) and the government will guarantee up to 15% (£27,579) of the loan with the mortgage lender. For more information please read our mortgage guarantee guide here.

Help to Buy ISA

On December 1st 2015 the Help to Buy ISA will become available, see our full story here.

First time buyer tips to get on the property ladder

- Consider purchasing your first property for under £125,000 to avoid stamp duty and keep your costs down.

- Start saving as much as you can as early as you can.

- DIY – Consider buying a house that needs a little work. Home improvements can considerably add value to your property.

- Place down as much deposit as possible to benefit from lower interest rates and cheaper repayments.

- Shop around for the best mortgage for you.

- Use the Help to Buy services.

- If you want to keep repair costs down consider buying a new build property.

For most people, purchasing a property is the largest financial commitment of their life, so it is vital to ensure you are ready and you can afford the mortgage repayments before you purchase a property. Listed below are the main costs you should account for when purchasing a property.

Main moving costs to consider when you’re buying your first home

- House deposit

- Stamp duty

- Valuation fee

- Surveyor’s fee

- Estate agent fees

- Removal Costs

- Mortgage fees

- Home insurance

Conveyancing Fees

At Howells we are transparent with our fees, and give you the overall cost for the purchase or sale of your property upfront.

We operate a no sale no fee policy and were recently awarded the Best Overall Conveyancing Firm of the Year 2015.

For a detailed quote from solicitors you can trust please call us on 02920 404 020 or email info@howellslegal.com.