Now that further information has been released regarding the Help to Buy ISA, we thought we'd revisit our previous post on the pros and cons of the Help to Buy ISA in order to offer additional information to our readers.

On December 1st 2015 the new Help to Buy ISA will be coming into place.

The following banks have confirmed they will be offering this product:

- Barclays

- Lloyds

- Nationwide

- NatWest

- Santander

- Virgin Money

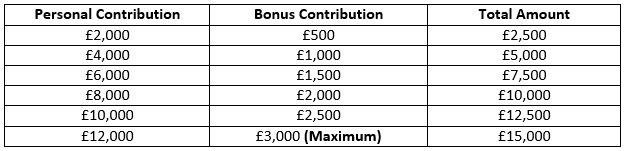

First time buyers only can save up to £200 per month towards a home, and the government will then increase these savings by 25%.

Please note: the maximum bonus amount has been capped at £3,000. This means you will need to contribute £12,000 of savings to get the full benefit from this ISA.

The Help to Buy ISA Explained

- The government Help to Buy scheme has announced that these accounts will not be limited to one per household, but in fact limited to one per person, meaning couples can benefit from an account each.

- The 25% bonus of the Help to Buy ISA account will only become available when purchasing your property and is limited to a maximum house price of £450,000 within London and £250,000 for all areas outside London.

- The Help to Buy ISA will have a 4 year lifespan, once you have created an account there is no restriction on the amount of time you are able to save for.

- When you open your account you will be able to make a first deposit of £1,000.

- You will not be committed to contributing £200 every month but £200 is the maximum amount for which the bonus can be awarded.

Please view the table below to see how you could benefit from the Help to Buy ISA.

For more information about the Help to Buy ISA, click here.

Residential Conveyancing with Howells Solicitors

Howells Solicitors is one of the leading conveyancing law firms in Wales and we pride ourselves on the high level of service that we provide our clients. If you’re saving for your first home, and would like to find out more about our conveyancing services for future reference, please click here. Or, if you would like to learn more about the home buying process, please see our detailed infographic.