We’re coming to the end of the financial year, and it is time to look ahead. In this update post, we summarise the recent changes in employment law and outline what to expect in the months to come.

Thank You to Our Clients

Thank you to all our clients for being so patient with us whilst we worked around the logistics of furlough and lockdown. It has been an interesting year in the world of employment.

The past year has been difficult to say the least. At the start of 2020, we had no idea what ‘furlough’ was or that there would be a global pandemic, that we would need to stay at home and not see our loved ones for months on end. We understand that the last year has been filled with uncertainty. We have had to adapt the way we work and how we work.

Although we are still in a lockdown, there is some optimism; we have a vaccine and there are signs that normality will resume come the summer.

What Has Changed?

26th March 2020

Working Time (Coronavirus) (Amendment) Regulations 2020: Emergency legislation was passed relaxing the restriction on carrying over the four weeks’ leave. Employees were permitted to carry-over of any untaken WTD (Working Time Directive) leave where it was not reasonably practicable to take in the leave year “as a result of the effects of the coronavirus”.

1st January 2021

- Immigration, Nationality and Asylum (EU exit) Regulations 2019: Free movement rights for EEA nationals ended on 31st December 2020 and has been replaced by a ‘Points Based System’ to anyone who is not British and Irish.

- Trade Rules: All businesses that move goods between Great Britain and countries in the EU or under the Northern Ireland Protocol must follow new customs and tax rules from 1st January 2021.

What is Changing Soon?

1st April 2021

National Living Wage: NLW currently applies only to workers aged 25 or over. From 1st April 2021, the NLW will be extended to workers aged 23 or over.

4th April 2021

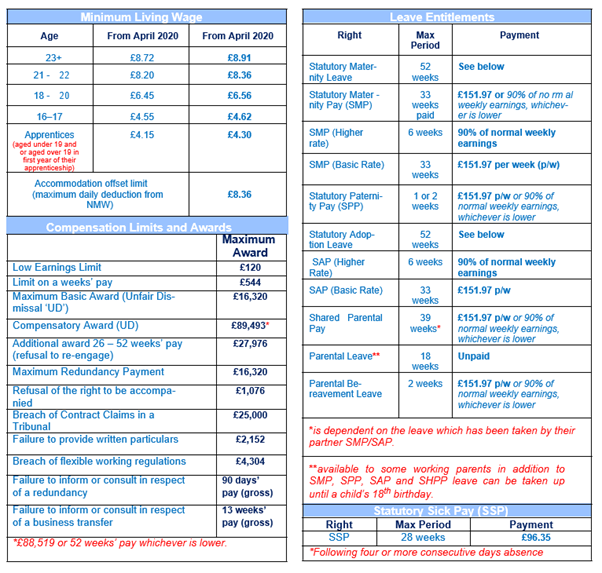

Statutory family payments: Increases statutory maternity, paternity, adoption, shared parental, parental bereavement pay come into force. Please refer to Statutory Rates 2021/22.

6th April 2021

- Statutory Sick Pay: Increase to SSP comes into force. Please refer to Statutory Rates 2021/22.

- IR35: The new rules shift responsibility for determining how a contractor ’s fee should be taxed from the contractor and their Personal Services Company to the end-user (‘client’). If the rules apply, the client will be responsible for deducting tax and other payments at source. Clients which fall within the definition of ‘small company’ are exempt from the changes. HMRC has also confirmed that, where the client is overseas and has no UK connection the new rules will not apply.

30th June 2021

EU Settlement Scheme: You can continue to employ EU Citizens until 30th June 2021, without worrying about the points-based system, as long as they are already living or working in the UK by 31st December 2020.

But they will need to obtain settled or pre-settled status to work here from 1st July 2021. If they do not have this, you will not be able to continue to employ them as they will become illegal workers.

30th September 2021

Coronavirus Job Retention Scheme: Rishi Sunak announced that the Coronavirus 2021 Job Retention Scheme (CJRS) will end on 30th September 2020. There is no intention to extend the CJRS any further at this stage.

More Information on the Coronavirus Job Retention Scheme (CJRS)

On the 3rd March 2021, Rishi Sunak announced that the CJRS would be extended until the 30th September 2021.

Furlough payments in March/April 2021 should refer back to the corresponding month in March/April 2019 not March/April 2020, as people might have already been on furlough pay during this period.

Under the extended furlough scheme, you can furlough employees who were employed and on payroll on or before 30th October 2020. You must ensure that they are eligible to be placed on furlough, please click here for more information on eligibility.

If you intend to place someone on furlough, you must in-form them in writing and they must agree to being placed on furlough leave.

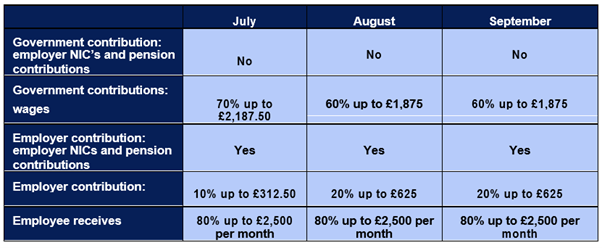

The CJRS will end on 30th September 2021. However, note that from 1st July 2021, the government will begin to wind down the CJRS. Please note below the following changes to the government contributions from 1st July 2021, are as follows:

If you have any specific questions regarding CJRS, please do not hesitate to contact us.

Other Need-to-Know Info

CJRS Eligibility from May

For periods from 1st May 2021 onwards, you will be able to claim for eligible employees who were employed by you and on your PAYE payroll on 2nd March 2021. This means you must have made a PAYE Real Time Information (RTI) submission to HMRC between 20th March 2020 and nd2 March 2021, notifying us of earnings for that employee.

You and your employees do not need to have benefitted from the scheme before to make a claim, as long as you meet the eligibility criteria.

Statutory Sick Pay

From 13th March 2020, employees and workers must receive any SSP due to them from their first day of self-isolation if it’s because:

- They have coronavirus.

- They have coronavirus symptoms.

- Someone in their support bubble has symptoms or has tested positive and they have been advised to ‘shield’ by the NHS.

- They have been told to self-isolate because they have been in contact with someone who may have coronavirus symptoms (as a result of ‘test and trace’).

- They’ve been advised by a doctor or healthcare professional to self-isolate before going into hospital for surgery.

Some employers can claim back up to 2 weeks’ SSP they’ve paid to anyone, please click here for more information on how to claim.

In Wales, social care workers are entitled to be paid full pay, under the statutory sick pay enhancement scheme, if they cannot work due to COVID-19. The scheme runs until 31st March 2021. To find out more information on an employees eligibility , please click here.

Please note, that employees and workers are not entitled to SSP if they’re self-isolating after entering or returning to the UK and do not need to self-isolate for any of the reasons listed above.

For example:

If you’ve been notified by the NHS that you have come into contact with someone with coronavirus and must self-isolate. From 28th May 2020, an employee is entitled to get SSP for every day you were self-isolating.

An employee should self-isolate if someone in their ‘support bubble’ or their ‘extended household’ has symptoms. From 6th July, an employee will be entitled to SSP for every day they were self-isolating. However, if the person with symptoms tests negative for coronavirus, their eligibility for SSP ends.

Carry Forward Leave

The government passed emergency legislation on 26th March 2020 relaxing the restriction on carrying over four weeks’ leave as a result of coronavirus. The purpose of the legislation is to support key workers, for example, nurses who were unable to take their annual leave during the leave year as a result of the pandemic.

The amendment allows for the carry-over of any untaken leave (four weeks) where it was not reasonably practicable to take it in the leave year “as a result of the effects of the coronavirus”. Carried over leave may be taken in the two leave years immediately following the leave year which it was due.

Government guidance suggests that the following factors should be considered in terms of whether it is reasonably practicable to take the leave in the relevant leave year:

- Whether the business has faced a significant increase in demand due to COVID-19 that would reasonably require the worker to continue to be at work and cannot be met through alternative practical measures.

- The extent to which the business’ workforce is disrupted by COVID-19 and the practical options available to the business to provide temporary cover of essential activities.

- The health of the worker and how soon they need to take a period of rest and relaxation. The length of time remaining in the workers leave year.

- The extent to which the worker taking leave would impact on wider society’s response to, and recovery from, the effects of COVID-19.

- The ability of the remainder of the available workforce to provide cover for the worker going on leave.

If you require your employees to carry forward any annual leave, please do not hesitate to contact us for advice.

Please note that you can require employees to take annual leave under the Working Time Regulations, if required, please contact us for further information.

Redundancy

The government has brought into force new legislation as a result of the pandemic. The new legislation ensures that furloughed employees receive statutory redundancy pay based on their normal wages, rather than a reduced furlough rate.

In addition to this, the changes will also apply to statutory notice pay and other entitlements. As a result, notice pay should be based on normal wages not their wages under CJRS. The changes will also ensure that basic awards for unfair dismissal cases are based on full pay rather than wages under the CJRS.

The aim of the legislation is to protect workers and ensure all furloughed employees who are being made redundant receive their full entitlement.

Business Secretary Alok Sharma said:

“We urge employers to do everything they can to avoid making redundancies, but where this is una-voidable it is important that employees receive the payments they are rightly entitled to.”

The new legislation came into force on Friday 31st July 2020.

Returning to Work

At present, England and Wales are both in lockdown, non-essential shops are closed and the hospitality sector has been forced to close as a result of the lockdown restrictions imposed in England and Wales. Please be aware that the rules are different in England, Wales, Scotland and Northern Ireland.

To read more on the restrictions in England, click here, and in Wales, click here.

As a result of the lockdowns in England and Wales, the public are urged to work from home if they can.

Immigration, Nationality and Asylum (EU Exit) Regulations 2019

From 1st January 2021, free movement ended for EU/EEA/Swiss Citizens. This means that if you employ someone who has come to the UK after 1st January 2021 from the EU/EEA/Swiss Citizen, you will need to hold a sponsor licence in order to sponsor these individuals under Tier 2 or 4 of the Points Based System.

EU/EEA/Swiss citizens already living in the UK on or before 31st December 2020, now have until the 30th June 2021 to make an application under the EU Settlement Scheme. If their application is successful, they will get either settled or pre-settled status.

To find out more about the EU Settlement Scheme, please click here.

To find out more about the new immigration rules, please click here.

Right to Work Checks

Although the UK has left the EU, the right to work checks will not change until the 1st July 2021. At present, the right to work checks for EU/EEA/Swiss citizens will remain the same, meaning they can still use their passport or national identity card until 30th June 2021, as long as they lived in the UK on or before 31st December 2020.

You must check that a job applicant is allowed to work for you in the UK before you employ them. If you are found guilty of employing someone who you know or had ‘reasonable cause to believe’ did not have the right to work in the UK, you could be sent to jail for 5 years and pay and unlimited fine.

If, however, you employ someone coming to the UK from EU/EEA/Swiss Citizen on or after 1st January 2021, you will need a sponsor licence.

If you are unsure of what documents you require to carry out a right to work check, please click here.

Key Cases

Aslam and Others v Uber BV and Others

The Supreme Court delivered their 42-page judgement on 19th February 2021, confirming that the Court of Appeals decision was correct. This means that Uber drivers are workers and not self-employed. This decision entitles Uber drivers to receive basic worker rights such as NMW and paid annual leave.

It will be interesting to see how this decision will be applied in the future and how much of an impact this decision will have on the gig economy’s business model.

Asda Stores Ltd v Brierley and Others

This is the UK’s largest equal pay group action in the private sector. Asda supermarket workers, mostly female, are contending that the work they carry out is of equal value to the work undertaken by their predominantly male colleagues working at Asda depots.

On 13th and 14th July 2020, the Supreme Court considered the preliminary issue of whether or not the supermarket workers are able to compare their pay with that of the depot workers.

The Supreme Court judgement is awaited in 2021. If the workers are entitled to equal pay, it is likely to cost Asda £8 billion. It will also mark progress for gender equality in the workplace.

Kostal UK Ltd v Dunkley and Others

The most important trade union case in recent years. The Supreme Court are due to hear the unions appeal on 18th May 2021. The Supreme Court will be examining whether the trade union legislation prevents employers from offering incentives to workers.

In this case, the employer had reached a stalemate with the trade union over a pay package and Christmas bonus. It wrote to its workforce directly, offering them a deal and threatening consequences if they rejected it.

The Court of Appeal overturned the two lower courts’ decision in favour of Kostal. If the Union are successful, Kostal will required to pay £420,000 to their workers.

Mencap v Tomlinson-Blake

The Court of Appeal held that under NMW regulations, workers are either available for work or actually working. Those who ‘sleep in’ are only available for work, therefore, only have to be paid at appropriate NMW rates if they have to get up during the night to help a patient or do some other work. They do not have to be paid NMW rates when they are in bed or resting.

The Supreme court heard the case on 12th and 13th February 2020, but we are still awaiting judgment.

Organisations on tight budgets welcomed the Court of Appeal decision. However, if the supreme Court reverses the decision, many will be exposed to claims from staff who have not been paid the correct NMW for ‘sleep-in’ hours (they may also be able to recover up to 6 years’ worth of underpayments).

The Numbers