If you compared the average household income of the country with the average property price, what do you think it would show?

Well, we’ve compared ONS data to find out just that.

Here’s what we found when we analysed the average mortgage to income ratio.

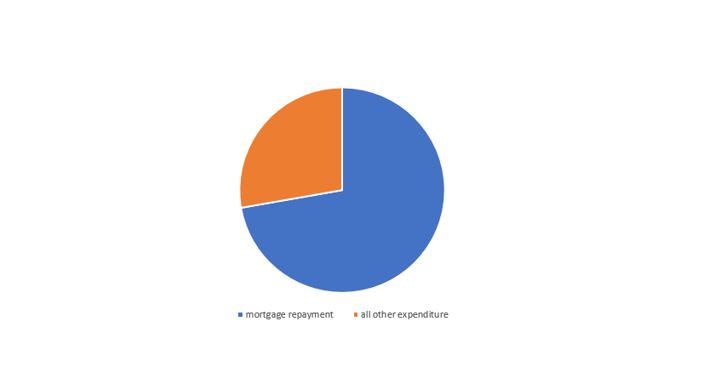

Mortgages Cost More Than Half a Household’s Income

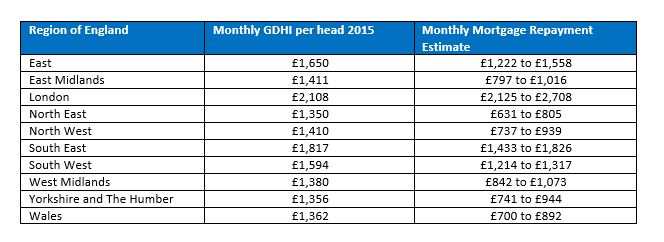

According to Office for National Statistics data, the median UK household disposable income was £19,106 per head (£1,592 per month) in 2015, whereas the average property in July 2015 cost £282,000.

According to Halifax, 25-year mortgage on a property this size could cost between £1,150 and £1,450 per month if a 10% deposit was put down, meaning that a household with one income would need to spend nearly three quarters of their household income on their mortgage (72.24% at the cheapest repayment rate, 91.08% at the highest) - something that simply isn’t manageable for most people.

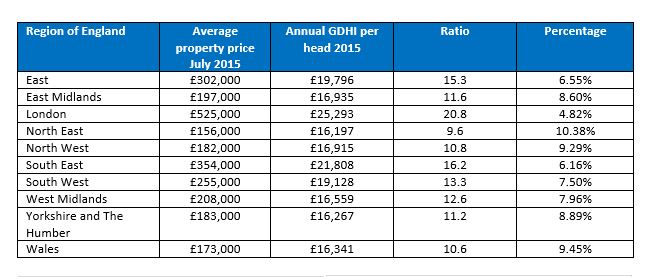

Further research has revealed that the age-old conundrum of location, location, location greatly influences affordability.

Where is the Most Affordable Place to Buy?

When we analysed the data, we found that the capital was the only place in the UK where monthly mortgage repayments were likely to cost more than the average income in 2015 – highlighting the large gap between rich and poor within the M25.

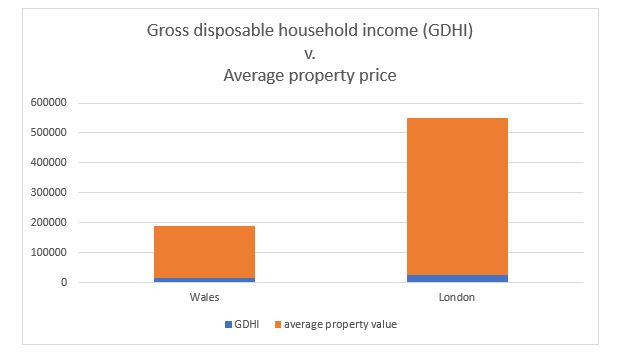

For the purpose of comparison, we chose an area close to home.

In July 2015, the average property value in Wales was £173,000, whereas the average property in London cost £525,000.

This disparity was less obvious when it comes to annual GDHI, with the gross disposable household income (GDHI) for Wales at this time being £16,341 and £25,293 in London, however the high property prices in London were enough to make it the least affordable place to buy in the country.

Further comparisons found that the further south the location, the less affordable purchasing a property was.

Speak to Howells Today

Howells’ trained conveyancing solicitors handle the sale of properties throughout England and Wales, operating a no sale no fee policy with fixed fees and no hidden extras. Find out more below.

Data and tools used: Halifax mortgage calculator, ONS House Prince Index UK: July 2015, and ONS Regional Gross Disposable Income (GDHI): 1997 to 2015.