"We can’t recommend Howells solicitors enough. Your service was excellent; all documentation was clear, prompt and made our move stress free."

Send us an enquiry - we will get back to you quickly

Enquire Now"I would like to thank you all for representing me during such a difficult period of my life. I would like you to be aware I was impressed with your dedication & professionalism."

Send us an enquiry - we will get back to you quickly

Enquire Now"Having worked in the city for over 20 years & dealt with major firm’s of solicitors, I was very impressed with the Commercial Department at Howells."

Send us an enquiry - we will get back to you quickly

Enquire NowConveyancing Fees and Service

We are a multi-award winning legal firm specialising in residential conveyancing. We consistently complete circa 900 conveyancing transactions each month which is testament to the good service that we provide.

A large percentage of our conveyancing work is from returning satisfied clients (over 30%), and from recommendations or referrals from estate agents.

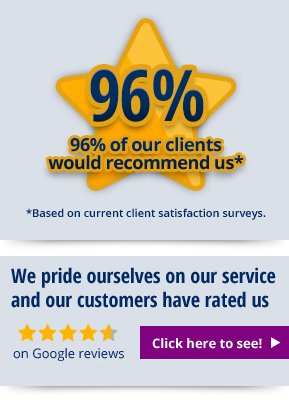

We are a top 20 conveyancing firm in the UK (source land registry stats), have excellent customer and introducer feedback on our service demonstrated by returned client questionnaires and also our high 4.8/5 google (and facebook) reviews/stars.

We believe we are the best in the industry and have the best staff, systems, clients and reputation to prove it.

We also know what a stressful time moving can be so as a firm we take on fewer cases to enable us to look after your individual needs so that we can provide you with a bespoke service. We only employ the best Conveyancing staff who have experienced and knowledgeable assistants supporting them. The Conveyancer will handle your case from beginning to end so your point of contact will not change and you will receive consistent communication and not be passed from one team to another.

If you receive any other quotes from other solicitors, we offer a free service whereby we can check these for you to ensure that all anticipated costs are accounted for. For example, if you are purchasing with a mortgage, you might not have been charged for all the searches that your lender requires. Sometimes a fee for dealing with your mortgage will be applicable (we do not charge this) but you may not be informed of this until you receive your invoice for completion of the transaction. Similarly, if selling a leasehold property, a leasehold supplement may be hidden in the small print.

We set out below some of the reasons why we consider ourselves to be the UK’s number one conveyancing firm (reference the Times/Sunday Times Awards and the LFS Awards):-

- We offer fixed legal fees and do not charge per letter or phone call.

- We offer a no sale, no fee policy.

- We provide our clients with direct phone / email access to a qualified experienced conveyancer.

- We receive excellent feedback – click one of the following links to see what our clients say about us:-

http://www.howellslegal.co.uk/testimonials

Howells Google Reviews

Facebook reviews - We offer complete transparency about our fees.

- We have achieved accreditation under the Law Society’s Conveyancing Quality Scheme.

- We are approved on all the major Bank and Building Society panels.

- We won the Professional Services award at the Cardiff Regional Awards 2018. In September 2018 we received the Gold award for Best Direct Conveyancing Firm in the UK at the Law Firm Services Awards and Silver for the Best Overall Firm in the UK. In December 2016 we were voted the Best Large Conveyancing Firm in the UK (Silver) at The Times / Sunday Times Awards and are now a multi award winning conveyancing firm.

- Please click here to see all of our recent conveyancing awards.

- We are consistently in the top 20 firms in the UK for numbers of transactions(source - land registry data).

- We regularly achieve fast completion times.

- A large percentage of our work is from repeat business, recommendations from friends/ family who have used us previously or from estate agent referrals / national builders who refer to us as they know we have an established track record of providing an excellent service.

Please see the below brochures for an idea of the services we provide for conveyancing and also the associated time frames.

Fees

Please click here for our average remortgaging fees if you are remortgaging a freehold registered property where there is only one prior mortgage to redeem.With regards our fees an average property price sale and purchase in the UK is £250,000.

Please click here for our average sale fees if you are selling a freehold registered property for £250,000 where no mortgage is involved.

Please click here for our average purchase fees if you are purchasing a freehold registered property for £250,000 where no mortgage is involved.

The fees provided are an average only so please contact us so that we can supply you with a written fully comprehensive no obligation quotation and at the same time answer free of charge any questions that you may have relating to the matter.

With newbuild transactions our legal fees will often be lower if we are familiar with the site. We pass on the time we save by knowing the development to our clients in terms of lower legal fees.

With leasehold transactions it is important that the lease is reviewed before the legal process is commenced and we are happy to do this free of charge. Many leases contain levels of ground rent, ground rent escalation clauses and other provisions that may be unacceptable to a lender . In our opinion it is therefore paramount in cases like these that before you incur valuation/survey costs that you receive sound advice at the outset. As leasehold transactions are invariably more complicated. Should we be instructed and should the matter complete a leasehold supplement will be charged with a range of between £100 - £300 plus VAT.

If you are having a mortgage, in most cases we will be instructed to act for your lender as well. In some instances they will instruct a separate solicitor at significant additional costs. If we do act for your lender, depending upon the nature of the transaction and circumstances and where we are so instructed we may raise an additional fee, which an average will amount to £90 plus VAT.

When acting for your lender some of the tasks undertaken will include:-

- Satisfy the lender that the property is good security for the loan/charge.

- Ensure that the certificate of title is accurate.

- Deal with and investigate any specific conditions that the lender may have.

- Report any defective title issues to the lender.

- Ensure that there is a good marketable title.

- Investigate/report any gifted deposits to the lender.

Disbursements

- Land registry fees depend on a set fee scale relating to the property value.

- Stamp Duty/ Land Tax fees depend on a number of aspects e.g.:-

The property Price

Is the property in Wales(Land Tax rate based on property price)?

Is the property in England(Stamp Duty rate based on property price)?

Are you a first time buyer as there are first time buyer incentives depending on the location of the property?

Is it a shared equity schemes?

Is the purchase a second home as a higher rate will apply?

If purchasing through a company different Stamp Duty/Land tax fee is applied.

Land registry fees will be higher for Newbuild properties - If purchasing 2 properties are they:

a) From the same seller as these will be treated as linked transactions for stamp duty purposes.

b) Are they from the same developer as these will be treated as linked transactions for stamp duty purposes. - Searches

For a freehold property where there is no mortgage the fee would be £0. If you are purchasing for cash you do not require any searches, however we strongly recommend that you have them.

If you are purchasing with a mortgage the lender will require that searches on the property are applied for.

Searches vary according to which local authority the property is located in and your lender may have its own specific requirements.

Searches can include local, personal, drainage, environmental, coal and chancel – again the fees vary according to which pack is necessary for your property/mortgage lender.

Depending on which Search Pack your lender requires the price varies from £120 - £335 plus VAT

What our fees do not include:-

Our prices are put forward on the basis that the title to the property is already registered at HM land registry and further that there are no defects with it. Additional charges will be incurred where we have to deal with problems arising out of such transactions. In the majority of our cases, the fixed fee provided at the start of the transaction will be the final fee payable. Depending on the complexity of the case these fees can vary. Rather than confuse you with a list of these charges, the majority of which will not apply, we will inform you of any additional costs during the transaction if any are relevant. No additional fees are ever charged to our clients unless they are fully discussed and agreed with the client before hand.All property transaction are different so for a complete breakdown of the fees for your case please contact us via our enquiry form or call us on 02920 404020