It would be a hard push to find anyone in the UK not affected, either directly or indirectly, by Covid 19.

There have been far reaching changes in our personal interactions (social distancing, cleaning of shared spaces, wearing of masks, etc.) and also in our interactions with businesses, for example the increase in online payments.

To navigate these changes, there have been instances of individual and community action. Whether it’s Capt. Sir Tom Moore or the local grocer setting up a vulnerable person’s delivery group, there have been many instances of help with the impact of Covid 19.

Many people are keen to help, but this may lead to unintended consequences as can be seen in the Bakery Manager case.

This came about through the rise in a cashless society and an increase in the contactless payment world. This has only been increased by the reluctance to handle cash in the current health climate.

Moving Towards a Cashless Society

Even prior to Covid 19, there were concerns of the impact that a cashless society could produce.

In March 2019, the Access to Cash Review was published, stating:

‘10 years ago, six out of every 10 transactions were cash. Now it’s three in ten. And in fifteen years’ time, it could be as low as one in ten.’

The Access to Cash Review highlighted that the UK was not ready to go cashless and that 17% of the UK population (over 8 million adults) would struggle to cope in a cashless society for reasons such as risks of isolation, exploitation, debt and rising costs.

In the review, various groups were identified as being disadvantaged by a cashless society because cash offers a degree of control, which digital monetisation doesn’t yet achieve:

- Those with physical and mental issues may find it hard to use digital services or need help with saving and spending.

- Some may risk overspending and going into debt as a result of not being able to budget through holding of cash.

- Many rely on others to buy things for them.

- Rural communities may have little or poor broadband connections.

- Those who can’t provide proof of their identity to a bank or financial services provider may encounter difficulties. For example, those who are new to the UK or those moving out of extreme poverty or homelessness.

Alzheimer’s Society, Cardiff stated in the review that,

‘We work for people with Alzheimer’s. They often find change extremely scary. They like to use cash because they are worried about holding up a queue if they can’t remember their PIN. This can stop them from going out as often into a confusing world.’

As can be seen, in a move towards a potentially cashless society, there can be substantial disadvantages for individuals and groups. This means that it becomes more important for people to have help with their financial wellbeing.

This financial assistance may be required during someone’s lifetime, but it also would be of paramount importance after someone’s death.

Your Digital Affairs After Death

In an increasingly digital world, it is also vitally important that your digital and analogue (or paper) affairs are in order. We can help manage someone’s affairs so that they are organised both during their lifetime and after their death.

As more people move towards digital finances, there may be more instances of surviving beneficiaries not having access to the digital elements of the deceased’s estate. We can help you prepare your digital affairs for after your death so that the necessary information is given to the appropriate people at the appropriate time.

Think, for a minute, of the list of the tasks that you perform online. For many, the list will be extensive and may surprise you.

For example:

- Online banking – Personal and/or business accounts, PayPal

- Online shopping – eBay, Amazon

- Utility bills

- Social media platforms (i.e. Facebook, Twitter, Instagram, YouTube, LinkedIn, Pinterest)

- Email accounts

- Betting sites

- Music sites

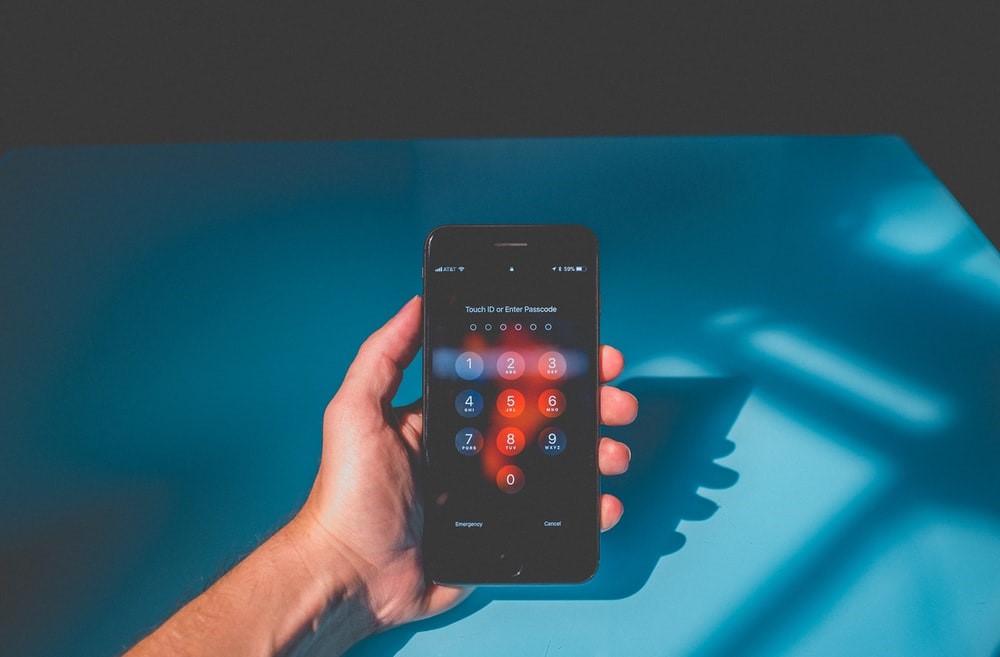

- And do not forget the passwords you use to access your pc and other devices in the first place!

Many of us also use our devices to store photographs and other personal information; be it on the hard drive of these devices or in cloud-based storage. These will all be significant to your loved ones after your death.

Create a Personal Assets Log

The Law Society recommends compiling a Personal Assets Log to include all of your digital assets. This document can be confidentially stored with your Will and can contain the information to help your executors after your death.

We can help you include the relevant information and give advice to you about the way that your Executors could safely and legally access your personal information during the administration of your estate.

Check the Terms and Conditions

Many of these websites do provide clear information; either on the website or in their Terms and Conditions. However, there are some websites, particularly those that are not UK-based, that will not enable the executor or next of kin to have access. There is strong potential for any information to be permanently deleted and for the account to be closed. This is due to different Data Protection Laws outside of the UK.

For those of us who subscribe to music sites or other digital libraries, the user is only an account holder and the content they access is just licensed to them. These are non-transferable and will cease upon the death of the account holder.

To ensure you are able to access photos, videos and other digital documents stored in cloud-based storage, we would recommend you consider saving them onto an external hard drive and storing this somewhere safely and securely. This will ensure your loved ones are able to access it.

How We Can Help

Through our expertise we are able to guide you through the rapidly changing landscape. We can draft the necessary documents which allow for a trusted individual to help you, legally, with your financial affairs. Through the creation of a Lasting Power of Attorney a person or people are able to help you control your finances and your welfare.

This may mean that a previously informal relationship becoming formally documented. Certain checks and balances can be created allowing for protections for the person giving the authority and also for the person acting as helper.

If you receive help, then speak with us, but also if you give help then we can help with the necessary protections for your relationship.

We also act on a professional basis as attorneys and as Deputies for those who are unable to validly execute a Power of Attorney. We are able to assist you with all of these situations.

If you are aware of a person who may benefit from our specialist expertise, then please contact us.