It’s an age-old dispute: parents are eager for their grown-up children to get onto the property ladder and the twenty-something kids claim it’s not as easy as it was back in Mum & Dad's heyday. But who is right?

To put an end to the debate once and for all, the Howells team have searched through house price history and income data from the Office for National Statistics to find out the truth: Was it more affordable to buy a house 20 years ago?

Is it Harder to Buy a House in 2017?

Here’s what we found:

• Properties are more expensive than ever

• House prices have risen well above inflation

• As a result, mortgage applications are down

• Furthermore, first-time buyers are getting older

Let’s look at the research in more detail:

Properties Are More Expensive than Ever…

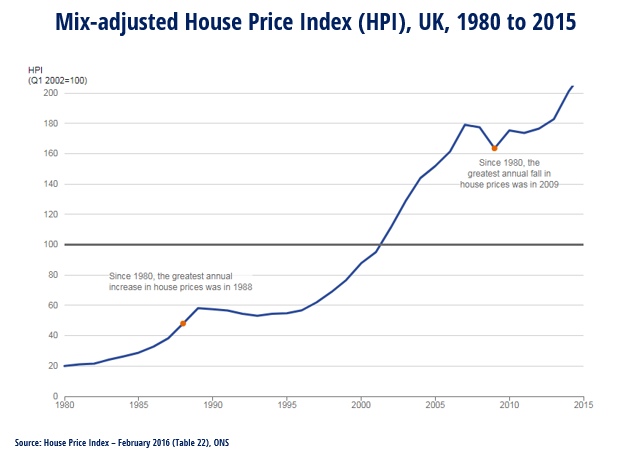

In 1980 the average home in the UK cost £24,000. By 1990, this had grown to £60,000 and ten years ago you could expect to pay just under £200,000. As of June 2017, the average UK property costs £223,257.

Property prices have increased on average 7% per year since 1980. The greatest annual increase during this time was in 1988 when the average house price went up 25.6%.

There have only been 4 years in the last thirty when property prices have not risen.

Properties Are Also Less Affordable

While properties are more expensive than ever, UK earnings are also higher than decades ago – but have they grown proportionally?

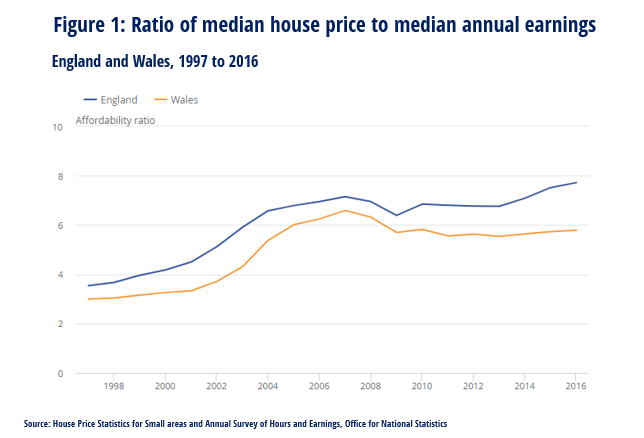

According to the Office for National Statistics and the Annual Survey of Hours (ASHE), median gross weekly earnings have grown from £268.90 to £438.60 between 1997 and 2016.

Despite this, in 1997, the average prospective homeowner could expect to pay up to 3.6 times their earnings on purchasing a home. Last year, the average person needed to pay around 7.6 times their earnings – more than double!

In this decade alone, residential property prices in England and Wales increased 259%, but median individual annual earnings grew just 68%.

The gap between the least and most affordable areas is now greater than ever and affordability has worsened across the entire country, London in particular.

In 2016, the most affordable local authority to buy in was Copeland, Cumbria, where property prices were on average 2.8 times more than annual earnings. On the opposite end of the scale, properties in Kensington and Chelsea cost 38.5 times more than the local average annual income.

Read more: What’s Britain’s Average Mortgage to Income Ratio?

First-time Mortgages Have Decreased Markedly Since 1980

The Office for National Statistics data clearly shows that properties are less affordable than twenty years ago, but is this reflected in the number of first time buyers taking out mortgages?

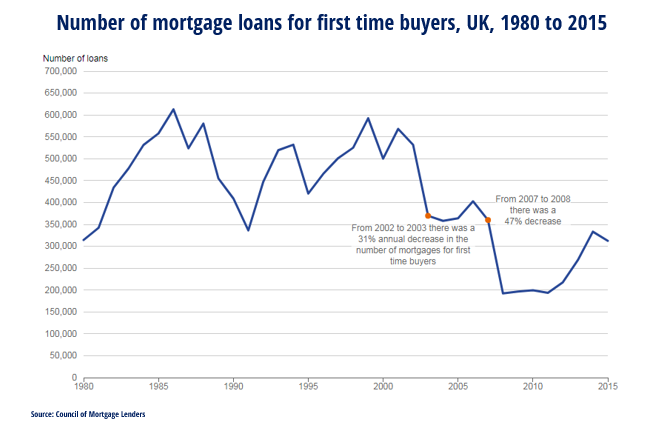

Unsurprisingly, less affordable housing has resulted in fewer mortgages being given to first-time buyers.

During the 80s and 90s there were between 400,000 and 600,000 loans to first time buyers each year, with 620,000 issued in 1986. Spiralling prices in the late 90s and early 00s saw first-time mortgages fall drastically – decreasing by 31% between 2002 and 2003. Then, 5 years later, the UK’s credit crunch saw a further 47% decrease.

Since then, despite rising house prices, the recovering economy has seen the number of first time buyers being accepted for mortgages begin to recover, however pre-2003 highs have not yet been met.

The Average Homeowner is Also Getting Older

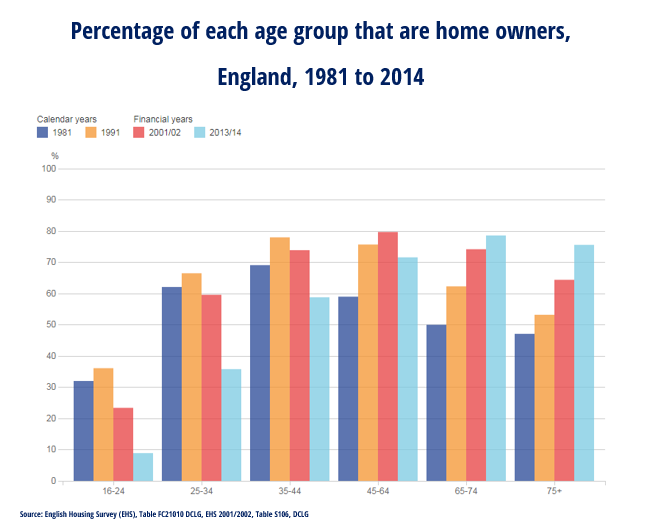

According to UK Perspectives 2016, the average homeowner is now older than ever before. In the decade 2005/2006 to 2015/2016, the mean age of first time buyers rose from 31 to 32.

Looking even further back, in 1991, 67% of 25 to 34 year olds owned their own home, compared to just 36% in 2014. During the same period, the number of homeowners aged 16 to 24 dropped from 36% to 9%, and aged 35 to 44 fell from 78% to 59%.

On the opposite end of the scale, the number of homeowners belonging to older generations has grown – more over 65s own a property than anyone else.

The numbers show us that those who bought their homes in the 80s and 90s unsurprisingly stayed on the housing ladder, but subsequent generations have found it much harder to buy their first home.

Not Enough New Builds Are Being Built

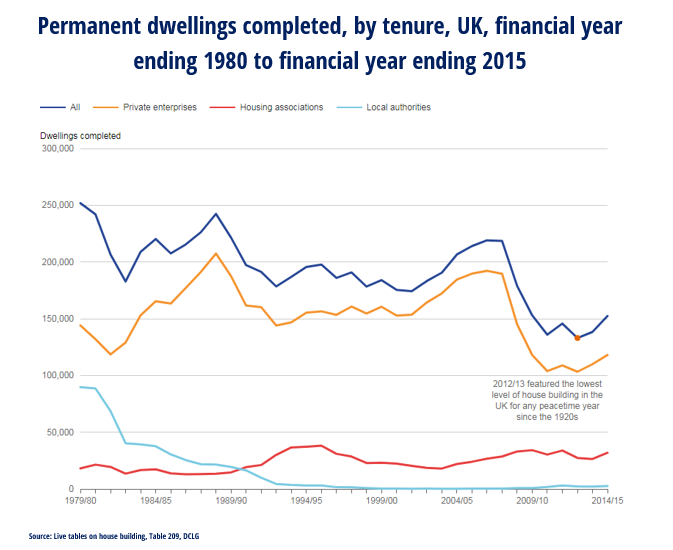

Younger generations' inability to get on the housing ladder is explained at least partially by the fact that house building in the UK has declined markedly since 1980.

In 1980, 251,820 properties were built, compared to 152,440 in 2015.

This lack of supply is helping to push up property prices amid high demand.

Read more: Help-to-Buy Statistics: 5,000 Homes Were Bought in Wales Using Help to Buy

Conclusion: It Was Easier to Buy a House in Your Parents’ Heyday

From the rise in 1988 to the crash twenty years later, the average cost of a home in the UK has frequently fluctuated, but overall a strong demand for housing has seen substantial growth in property prices.

Furthermore, with affordability decreasing it’s no surprise that first time buyers today will find it considerably harder to get onto the property ladder compared to their parents or anyone else purchasing 10, 20 or even 30 years ago.

It’s not all bad news though. There are schemes out there such as Help To Buy which are bridging the affordability gap and giving some prospective homeowners the chance to buy their first property. In fact, nearly 5000 homes in Wales alone have been bought using the popular Help to Buy scheme.

Commenting on the results of this study and the effects it has had on the conveyancing industry, Tristan Lewis, Business Development Manager of Howells Solicitors said:

“With property prices considerably higher than twenty years ago, we have become familiar with the requirements of first time buyers for an affordable conveyancing service during these demanding times. However, the comparison of these values against income data has reiterated this further.

To combat these issues, Howells offers a fixed fee conveyancing service with no hidden extras and a no sale, no fee policy. We pride ourselves on making moving home as straight-forward as possible and look forward to helping even more people purchase their first home.”

Matt Stevens, Director of Mortgage Genie, shared his thoughts on Howells’ report. He advocates recent changes in the property finance industry and has added:

‘Looking back to mortgages 20 years ago, it's important to remember that August 1997 saw a Bank of England base rate of 7%. This saw an increase of 0.25% by November that year — an increase alone that is the equivalent of today's base rate.

'Since then, we've seen a continual expansion of the mortgage market, with more options and products for clients.

'Over the last 20 years, we've also seen an increase in regulation, ensuring mortgages are much more carefully agreed. Plus, these days, clients have the opportunity to work with fully-qualified and regulated professionals, who are easily accessible and will always be willing to help. This is in stark contrast to the very limited options available to clients 20 years ago.’

How Can Howells Help?

If you’re buying a home, our expert conveyancing solicitors can provide you with a quality and value for money conveyancing service.

With a fixed fee, no hidden extras and a no sale, no fee policy, we pride ourselves on making moving home as simple and straight-forward as possible. Plus, 96% of our clients would recommend us*.

Alternatively, if you would like to learn more about the aforementioned Help-to-Buy scheme in Wales, we’re happy to share our knowledge.

Data sources:

UK Perspective 2016: Housing and Home Ownership in the UK

Housing Affordability in England and Wales: 1997 to 2016

ASHE 1997 to 2016 selected estimates

English Housing Survey 2015 to 2016