Here at Howells our expert property solicitors are always happy to help and answer any queries you may have about the conveyancing process.

We’re often asked about the disbursements involved with buying a first home. Here are some frequent questions:

Q: As a first time buyer, what costs and disbursements do I need to consider when purchasing a property?

A: Buying your first property is an exciting time, however it is important that you are aware of the cost and disbursements that face you.

Firstly, your legal fees would be agreed with your solicitor/legal representative when you instruct them. The legal fees are the charges payable for the work that is carried out on your behalf, including checking the title of the property, reviewing searches, reviewing your mortgage offer and registering your ownership on completion.

On top of your legal fees, there are a number of other expenses which you will need to be aware of. Your Solicitor will order searches on your behalf which will reveal more information about the property and also may raise some potential issues with the property. The searches are ordered once the contract pack is received from the vendor’s solicitor. If you are having a mortgage with your property searches the lender will require these to be completed. If you are a cash purchaser property searches are optional, however we would highly recommend these are carried out.

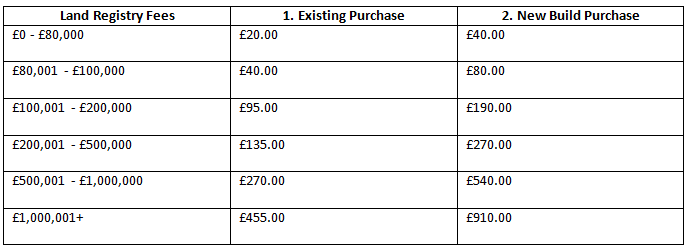

Other disbursements you will have to pay include Land Registry fees for registering the property (the fee depends on the purchase price of the property).

*Please note: Other firms may quote higher for land registry fees if they do not electronically register the title.

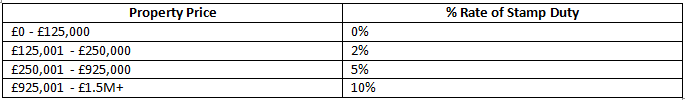

When purchasing a property your solicitor may carry our various checks, including anti –money laundering and bankruptcy searches. During the conveyancing process your solicitor will also need to carry out a telegraphic transfer, this is used to electronic transfer funds for your property purchase. Please remember that whenever the purchase price is more than £125,000, you will be liable for Stamp Duty Land Tax.

*Please note: If anybody involved in the property purchase isn’t a first time buyer and owns a second home / buy to let property and are not replacing their main residence, they may be liable for the higher rate of stamp duty.

Read more:

For all you need to about the higher rate of stamp duty please see our previous story here; https://www.howellslegal.co.uk/news/post/No-Change-in-Budget-Stamp-Duty-Changes-Will-Take-Effect-at-Start-of-April.aspx

How Much Does it Cost for First Time Buyers?

Buying Your First Home with Howells Solicitors’ Help

A clear breakdown of all legal fees and other disbursements should be provided by your solicitor/ conveyancer. Costs will differ from case to case depending on a number of factors, for example; if you’re purchasing a leasehold property there can be additional costs associated with this.

For more first time home buyer information about the purchase process, from saving a deposit all the way to completion, read out informative guide and view our visual infographic; Howells Solicitors’ Guide to Buying Your First Home.

Howells Solicitors offer fixed fee conveyancing quotations with no hidden extras. Contact one of our friendly and qualified property solicitors by calling 0808 178 2773.