Around 180,000 people a year die intestate (without making a Will). That is a shocking 56% of UK deaths. This might sound gloomy, but are there any pros to not making a Will? Here, our legal experts look at the positives of giving all of your capital to the state by default…

1. Responsibility

A Will puts you in control. It allows for your wishes to be expressed and acted upon when you have passed away. You will have to choose who shall benefit from your estate and what they are entitled to. You also decide who will administer your affairs after your death… but, who wants that kind of responsibility?

2. Intestacy Rules

If you do not want that kind of responsibility and independence, then not having a Will in place will result in the beneficiaries of your estate being decided by the intestacy rules. Some would say that the results of this can be undesirable; however, if you don’t want a say in the delegating of your assets, then not having a Will is the best choice for you.

The law sets criteria, laying out the hierarchy of who may handle your financial affairs after death and this can lead to issues should a person be unsuitable on the grounds of age, geographical location or age. However, you probably wouldn’t want your loved ones to decide on these matters anyways…

3. Qualified Solicitors

Making a Will through a suitably qualified solicitor reduces the chances of disputes and other problems. Disputes are more likely when someone dies without a Will, as certain people are entitled to apply to a court to challenge the provision made by the intestacy rules if their outcome is deemed to be unfair.

For example, a long standing unmarried partner would receive nothing under the intestacy rules, so may have to consider making an application to a court to be awarded a share of the estate. A large amount of stress and expense can be incurred by the recipients of such claims; but who doesn’t enjoy a challenge?

Read more: Why Use a Probate Solicitor?

4. Court Interference

Whilst Wills can be challenged on the basis of being unfair, the courts are more reluctant to interfere in the matters laid out in a Will than those established by the intestacy rules. This is because you will have exercised your right to choose the recipients of your hard-earned capital.

But, if you like long, traditional ceremonies, not having a Will in place can mean your loved ones frequenting court buildings for substantial periods of time.

5. Costings

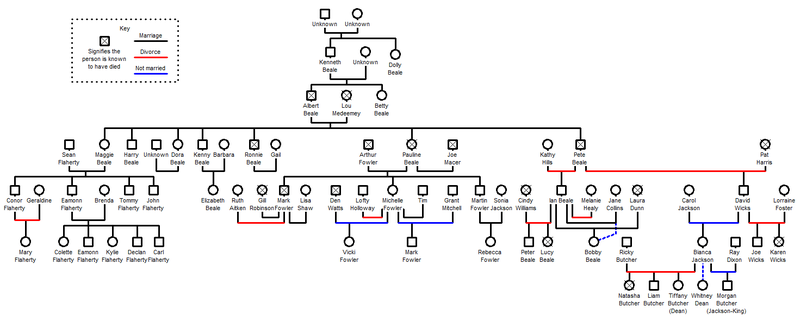

If you die without a Will, it may be necessary for your estate to commission genealogical research, in order to identify any possible unknown relatives. This can be very expensive and time consuming, but provides interesting information on your lineage that a Will written by you would not highlight. Many people have long-lost relatives, so the gamble might be worth it…

6. Dividing Your Estate

The intestacy rules will divide your whole estate; therefore, if more than one person is due a share, this can necessitate the sale of assets, should all beneficiaries not wish to keep them as they are. Whilst having a Will enables you to preserve and protect your assets for your beneficiaries, not making a Will means that a share of your estate can be sent charitably to beneficiaries whom you may not have initially chosen.

7. Protecting Beneficiaries

A Will ensures that adequate provisions are in place for those who need it, whilst protecting assets for other beneficiaries.

For example, married couples can very easily set their Wills up to protect a share of their home from being used to pay for care fees, whilst giving each other the comfort of knowing that the property is available for the survivor to live in for as long as it’s required.

Equally, for couples who each have children from previous relationships, a trust can be used to ring-fence a part of the estate for those children. Otherwise, the intestacy rules may result in all the marital assets being passed down to the surviving spouse, with the children of the first spouse receiving nothing. This, in effect, produces a lottery, with the prize going to the children of the second spouse when they die.

If you want take that gamble, then dying without a Will makes sense; doing so will also teach your children that life isn’t always fair.

Read more: Next of Kin – What Are My Rights?

8. Means-Tested Benefits

A properly drafted Will enables someone to manage the inheritance left to a disabled or otherwise vulnerable person. If done properly, this can mean that the relevant recipient(s) will not lose their means-tested benefits. If you do not wish to ensure the security of your dependents and the vulnerable, then not having a Will in place is the way to go.

9. Court-Appointed Deputies

People who lack capacity are unable to give valid receipt for their share of an estate. Therefore, if you die without a Will and leave a share of your estate to a vulnerable or disabled beneficiary, the person handling your estate may need to insist on someone applying to be a court-appointed deputy for the beneficiary before they receive their due share.

This can prove to be expensive and time consuming, but surely the courts know best and the extra cost will no longer be your issue.

10. Children and Your Funeral Arrangements

Should you pass away whilst your children are minors, a Will allows you to nominate someone to act as a guardian for your children. Also, a Will allows for the formal recognition of your desired funeral arrangements. However, if you are not particularly bothered about who brings up your children, the courts can decide for you and the worst-case scenario would be the Local Care Authority.

Do You Want to Write a Last Will and Testament?

Obviously, the ‘positives’ laid out here are superficial. If you would like to ensure that you safeguard the futures of your loved ones, especially those dependent on you, then a Will is the only way to formally safeguard these interests.

Our team of legal experts specialise in Wills and Probate law and will be more than well-placed to ensure that your needs are accommodated and interests protected during what is usually a difficult time for all parties.

To arrange an appointment with one of our Wills and Probate specialists, please call 02920 404020 and 01792 410016 today for a no obligation free assessment of your case.

(family tree image: AnemoneProjectors under CC BY-SA 3.0)