In his Autumn Statement Chancellor George Osbourne announced buy-to-let landlords and people buying second homes in England and Wales will have to pay an additional 3% on each stamp duty band from April 2016.

Mark Hobbs, managing partner of Howells Solicitors, one of the UK’s largest conveyancing firms, anticipates that this will prompt an increase in activity by investors as they rush to complete property transactions before the April deadline. This flurry of activity is then likely to be followed by a lull in the property market after the new changes have come into place, and this might benefit first-time buyers.

“At this early stage it is very hard to predict how this change will impact the property market. After the initial rush to complete transactions in the run up to April next year, there is likely to be a lull in the marketplace. This could be good news for first time buyers, as there may be less competition for certain types of property that would otherwise have been purchased by investors.”

“In my opinion this could have a very positive effect in the marketplace in the latter half of next year. In the slightly longer term, if the additional tax reduces the number of buy-to-let properties being purchased, this will create less supply, and with an ever-increasing demand in the rental sector, is bound to result in an increase in rental fees. If rents do increase, this is likely to increase the yield in property and then in my opinion in the longer term it is unlikely to be significantly affected by these changes”.

New Stamp Duty Rates Will Have an Impact on Welsh Buy-To-Let Market

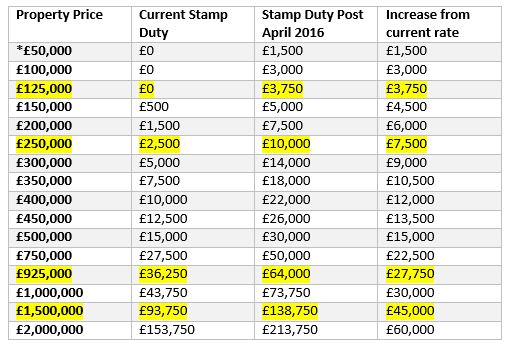

The 3% rate might not sound that significant, but when you consider that it will increase the stamp duty bill on a £175,000 buy to let from £1,000 under the current band to £6,250 then it becomes clear that the jump is considerable.

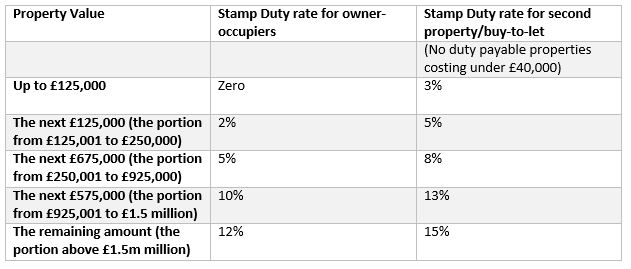

The chancellor’s statement initially left many experts confused about how the new stamp duty rates will be applied. Treasury documents released immediately after the speech implied that the first £40,000 would be tax free. Later though it was confirmed that, for all purchases above the £40,000 price, the 3% extra tax applies on the entire property price.

Mark Hobbs, after assessing the potential impact for landlords in Wales, said:

“The changes will perhaps have more of an effect in Wales because the average buy-to-let property is valued at £120,000. This means that for the first time landlords purchasing houses valued under the traditional £125,000 threshold will have to pay 3% stamp duty on properties over £40,000.”

Continuing he said: ”It should also be borne in mind that with house price inflation forecast at circa 25% over the next five years, and with the possibility of increased rents, that the payment of an additional sum of stamp duty is not likely in the longer term to have any major significance.

Whilst the changes will have a significant financial impact for buy-to-let landlords and those looking to purchase a second home, there are others who may find themselves in a situation where they might already be home owners but are seeking to purchase a property to live in. What will the implications be for people buying second homes that started the buying process before the beginning of April 2016 but completing after the beginning of the month? We are awaiting with interest the details regarding the Stamp Duty surcharge increase.”

Stamp Duty Scenarios

We’ve listed some possible scenarios below and have asked the necessary questions to get clarification.

***UPDATE***

Please note: See updated publication (28/12/15) from HM Treasury regarding; Higher rates of Stamp Duty Land Tax. If you are purchasing a second home or buy-to-let property please review the examples included in the publication to see what stamp duty you would be liable to pay.

Scenario 1

Mr Hilbourne already owns his own house. He has put an offer in on a second property but the expected completion date is after the beginning of April 2016. Will Mr Hilbourne be expected to pay the additional 3% Stamp Duty on the new property?

Scenario 2

Mr & Mrs Lewis are helping their daughter buy her first house. The parents and daughter will have joint ownership of the property. Mr & Mrs Lewis already own their home and their daughter is a first time buyer, will the 3% Stamp Duty be applied to their purchase?

Scenario 3

Mr & Mrs Lewis are helping their daughter and her boyfriend buy their first house by providing her with part of the deposit (e.g. £15,000). The daughter and son-in-law will be the only parties on the mortgage and title deeds but Mr & Mrs Lewis will have a declaration of trust to protect their deposit should the relationship breakdown. Mr & Mrs Lewis already own their home and their daughter and boyfriend are first time buyers, will the 3% Stamp Duty be applied to their purchase?

Scenario 4

Mr Hetfield exchanges on his buy-to-let property at the end of March but the purchase doesn’t complete until the first week of April. Will Mr Hetfield be charged the additional 3% Stamp Duty on his purchase?

Scenario 5

Mr Edwards separated from his wife over three years ago. Mr Edwards left the family home but remains on the mortgage. Mr Edwards is now remarried and wants to purchase a property with her. Will Mr Edwards be expected to pay the additional 3% Stamp Duty on his purchase?

Scenario 6

Mrs Lucas inherited a house from her late parents. She would like to keep this property but wants to buy her own to live in? Will Mrs Lucas be affected by the 3% increase?

Buy to Let/Second home Stamp Duty from April 1st 2016

*Under the new rules from April 1st anyone purchasing a buy to let property or a second home will pay 3% stamp duty on properties over the £40,000 price.

Get Conveyancing Advice from Howells Solicitors

Howells Solicitors is one of the leading conveyancing law firms in Wales and we pride ourselves on the high level of service that we provide our clients. Our dedicated team of experts are on hand to make the conveyancing process as simple and as straightforward as possible, always ensuring that our clients receive the personal service that they deserve.

To find out more about our services and get a breakdown of our fees, call 0808 178 2773.