The Chancellor of the Exchequer, George Osborne, has today (December 3rd 2014) revealed a new regime for Stamp Duty Land Tax, which will produce a much lower tax change for most buyers.

Commenting on the Stamp Duty Land Tax Reforms announced yesterday in the Autumn Statement, Mark Hobbs, managing partner of Howells Solicitors’, Wales’ largest residential practice welcomed the changes saying that they were “sensible and good for the market.”

The law firm is responsible for over 800 residential property completions each month. Although the immediate changes to the system have resulted in the accounts department at the law firm working overtime to ensure potential complications caused by the reforms for home buyers due to complete today and in the next couple of days are managed accordingly, they do allow clients to chose whether to pay the tax at the new or current rate depending on which is best for the buyer.

Mr Hobbs said, “The reforms remove the big hikes in Stamp Duty at former pinch points especially for properties in the £250,000 and £500,000 categories. Big savings in the middle market will push more sales along next year which might counter the traditional pre election lull. One could argue that it is a clever political move by The Chancellor of the Exchequer as it placates those calling for the introduction of a Mansion Tax but from a conveyancing viewpoint the reforms are fair and will benefit those taking their first steps on the property ladder as well as those moving up it.”

Summary of Stamp Duty Land Tax Reforms

• The new rules take effect from 4th December 2014

• No tax on the first £125,000 paid

• 2% on the portion up to £250,000

• 5% up to £925,000

• 10% up to £1.5 million

• 12% on everything above £1.5 million

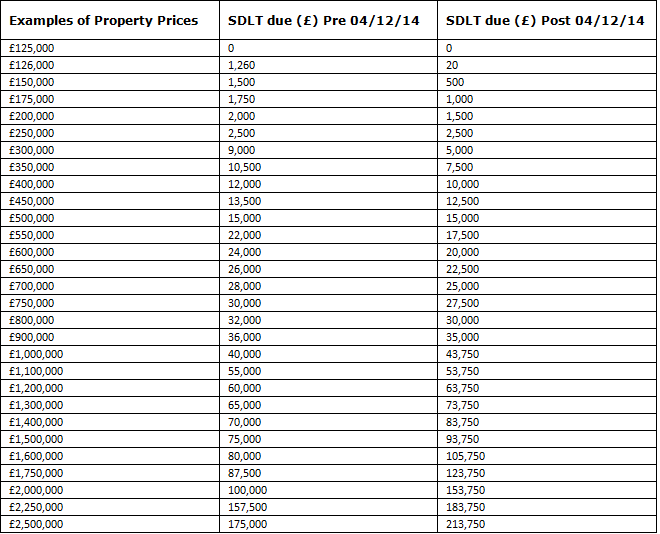

The significant difference between the current and new systems is the rate of tax in each bracket will apply only to the particular slice of the price to which they apply, not the whole value of the property, as has previously been the case. For example, on a house being bought for £300,000 the tax due under the old system would be £9,000, but now it will be just £5,000.

The ability in the short term to choose will provide benefits for all said Mr Hobbs. “For the majority of buyers who have exchanged but yet to complete they will benefit from the changes. However, there will be some purchasers who are committed to buying very expensive properties and they would be worse off from 4th December 2014 but the Chancellors decision to allow all to choose which tax rates to use for a defined period will help these.”

When Will the New Stamp Duty Land Tax Take Effect?

The new rules take effect from 4th December 2014. If you have exchanged contracts but will not complete your purchase until the new rules are in force, the chancellor has said: "you will be able to choose whether to pay under the old system or the new, so no one in the middle of moving house will lose out."

It will be a no brainer for a lot of purchasers who have exchanged but not completed to opt for the new rules. There will, however, be some people out there who are committed to buying very expensive property and they would be worse off from 4th December 2014 but for their ability to choose the old rates.

Please see the below table which illustrates the difference that the new stamp duty land tax rules will make (from todays Autumn budget) for people looking to purchase a residential property.

Get Legal Conveyancing Help Today

As one of the leading firms of residential conveyancing solicitors in Wales we pride ourselves on providing up-to-date legal advice that is specific to your circumstances. If you’re thinking about buying or selling a property and want more information about how these changes may affect you, simply get in touch with us today on 080 178 2773.